Article Directory

It wasn't the political saber-rattling that broke the crypto market last Friday. It was the leverage. President Trump’s threat of 100% tariffs was merely the catalyst—the stray spark that ignited a bone-dry forest of over-leveraged positions. What followed was a cascade failure of historic proportions, a $19 billion liquidation event that vaporized the accounts of more than 1.6 million traders in a single 24-hour period. At its peak, the market was flushing out $7 billion in a single hour.

This wasn't just another volatile day in crypto. This was a system-wide stress test. When the dust settled, the event had produced a dataset of profound clarity, drawing a sharp, undeniable line between two competing visions for the future of finance. One buckled under the strain, revealing its fragility. The other performed exactly as designed. The numbers tell a story not of market chaos, but of infrastructural divergence.

The Central Point of Failure

As the price of Bitcoin plunged 16% from its all-time high of $125,000, the centralized exchanges—the primary gateways for most retail traders—began to seize up. Reports flooded in of failed orders, frozen screens, and the inability to close positions as margin calls were triggered en masse. This is the recurring nightmare of a trader in a black swan event: you see the cliff edge, you try to hit the brakes, but the system becomes unresponsive. You can only watch.

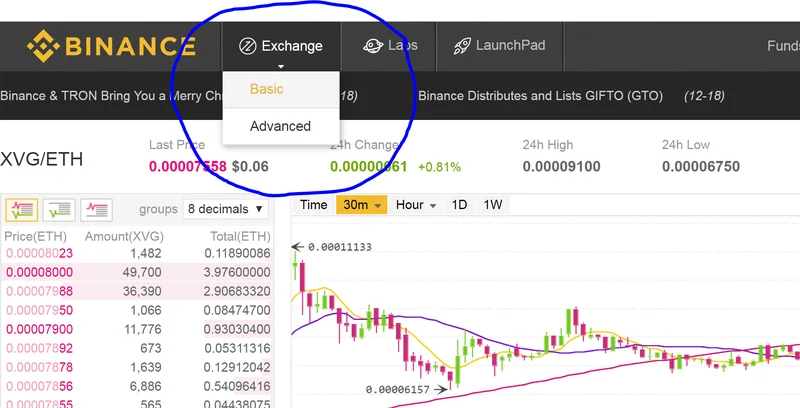

Binance, the largest of these exchanges, was at the epicenter. In a statement on Saturday, co-founder Yi He acknowledged the "significant market fluctuations" and "substantial influx of users" had caused "issues with their transactions." The company’s proposed solution is telling. Binance offers compensation after $19bn crypto crash that crippled centralised exchanges, boosted DeFi, but only for losses "attributable to Binance." Losses from market volatility or unrealized profits (the money a trader could have made if an order had gone through) are explicitly not covered.

This is, of course, a public relations masterstroke that is a logistical nightmare. How does one definitively prove a loss was caused by a Binance system failure versus a dozen other factors in a market meltdown? Was it their server lag, an internet provider issue, or simply the overwhelming volume of sell orders clogging the order book? The distinction is crucial, and I've looked at hundreds of these corporate post-mortems; the ambiguity in that statement provides a significant operational buffer. It’s a promise that sounds reassuring but is incredibly difficult to audit on a case-by-case basis.

The core issue isn't one of bad faith, but of architecture. Centralized exchanges are black boxes. Their internal mechanisms, their server capacity, their order-matching engines—it's all proprietary. When they fail, users are left with little more than a customer service ticket and a corporate statement. The system relies on trust in the operator, and on Friday, that trust was severely tested. What happens when the entity you trust to execute your commands is the very same one that buckles under pressure?

An Uninterrupted Ledger

While centralized platforms were issuing apologies, a different story was unfolding on-chain. The world of decentralized finance, or DeFi, faced the exact same tidal wave of volatility and transaction volume. Yet, the outcome was fundamentally different. There were no press releases about system disruptions. There were no emergency circuit breakers. There was only code executing contracts.

The data is stark. Uniswap, the largest decentralized exchange, processed a record-high daily trading volume of $10 billion. There were no reports of downtime. Aave, a leading lending protocol, handled over $180 million in collateral liquidations in a single hour. Aave’s founder, Stani Kulechov, rightly called it "the largest stress test of its $75B+ lending infrastructure." The protocol didn't just survive; it functioned flawlessly, automatically liquidating under-collateralized loans as programmed. The protocol’s fees, a direct measure of its activity, jumped about 5x—from an average of $3 million to a peak of $15 million in one day, to be more exact.

Michael Bentley, co-founder of lending protocol Euler, summarized the event: "Just free markets and code." It’s a pithy line, but in this context, it’s also a technically accurate description of what occurred. The DeFi protocols didn't need to "handle" the volume in the way a company does, with support staff and server reboots. They are autonomous systems. The rules are written in smart contracts, visible to all, and they execute without prejudice or interruption.

And this is the part of the data that I find genuinely puzzling from a legacy finance perspective. The DeFi liquidations were brutal and unforgiving, but they were also transparent and orderly. There was no single point of failure because the system is distributed by design. The entire event serves as the most potent, real-world validation of DeFi's core premise to date. It’s an infrastructure built for hostility, one that doesn't require a trusted intermediary to function. The stress test demonstrated that the code is, in fact, the counterparty. Is that a system everyone is comfortable with? Absolutely not. But on this particular Friday, it was the only one that worked.

A Tale of Two Infrastructures

Last week's crash wasn't just a financial event; it was a live, multi-billion-dollar A/B test comparing two foundational architectures. On one side, we have centralized systems that offer a familiar user experience but conceal their operational risk behind a corporate veil, a veil that was torn away by the sheer force of the market. On the other, we have decentralized protocols—impersonal, transparent, and ruthlessly efficient. They offer no customer service hotline, but they also require no apologies for system downtime. The data has rendered its verdict. The question is no longer which system might be more resilient. The question now is how long the market will continue to rely on the one that demonstrably isn't.