Article Directory

So, the founder of the world's biggest crypto exchange gets a presidential pardon.

Let that sink in for a second. While federal agents are busy making puns at a press conference about busting some low-level mafia guys for an NBA betting ring, the guy at the very top of the digital casino gets a golden ticket out of whatever mess he was in. And we're supposed to just nod along, check the price of Bitcoin, and accept that this is how things work now.

I’ve been watching the tech world long enough to know that "disruption" is usually just a fancy word for finding a new, more efficient way to break the rules. But this? This is next-level. This isn't just breaking the rules; it's getting the guy who writes the rules to personally rip them up for you. The White House struggles to defend Trump’s pardon for founder of Binance crypto exchange. Struggling? Give me a break. That’s the kind of PR-speak they use when they know it’s indefensible, but they have to put on a show for the cameras. The real defense is one they can't say out loud: "Because we can."

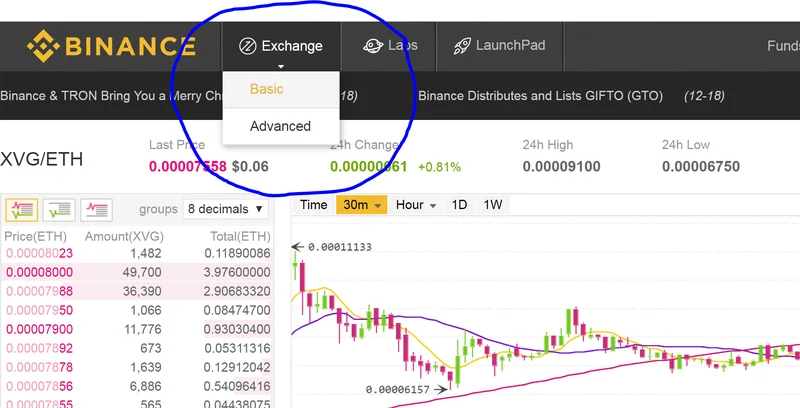

And honestly, what is Binance at this point? Is it the best crypto exchange for the average Joe to get his feet wet? Or is it a financial black box so enormous and globally entangled that the powers that be decided it was easier to pardon its founder than to deal with the fallout of holding him accountable? I don't know the answer, and I'm willing to bet the reporters asking the questions don't either.

A Market Built on Faith and Favors

While the ink is still drying on that pardon, I'm looking at these charts from a crypto analyst named Amr Taha. He’s pointing out that Bitcoin Reserves On Binance Fall To July Lows — What This Means For Price. He calls the decline "extremely aggressive" and suggests it could lead to a "supply shock" that sends prices to the moon.

The narrative here is that everyone is so confident, so bullish, that they’re pulling their Bitcoin off exchanges to hold for the long term. They’re taking their chips off the table to store them in a vault. It’s a sign of strength, of conviction. People are rushing to buy bitcoin binance and then immediately hiding it under their digital mattresses.

But here's a question nobody seems to be asking: is it really conviction in the asset, or is it a sudden, terrifying loss of faith in the institutions holding it?

Think about it. The platform's founder is embroiled in a controversy so huge it requires a presidential pardon. You have your life savings sitting on their servers. Do you feel more confident or less? Maybe, just maybe, people aren't pulling their coins because they expect the price to hit $200k. Maybe they're pulling them because they've finally realized the entire system is built on a foundation of sand, held together by backroom deals and political favors. It's like finding out the bank manager just got a pardon for embezzlement and then being told the long line at the ATM is a sign of customer confidence. It's insane. No, 'insane' doesn't cover it—it's a full-blown gaslighting of an entire market.

The whole thing is a fragile house of cards. And while we're all distracted by the drama, I keep getting served these endless, mind-numbing legal notices. Seriously. In the middle of trying to figure out the implications of a presidential pardon for a crypto titan, my browser is hijacked by a twenty-page "Cookie Notice" from NBCUniversal. It’s a perfect metaphor for the modern age: a monumental event of questionable legality is happening in plain sight, but corporations are more concerned with making sure you know they're tracking your clicks. The priorities are... something else.

Same Game, Different Stakes

It’s almost poetic that on the same day we’re talking about a crypto pardon, the US Attorney’s office is patting itself on the back for busting a mafia-linked sports betting scheme. The officials were reportedly cracking jokes and making puns. How cute. They caught a few guys using insider info to bet on NBA games. They’ll get their wrists slapped, maybe do some time, and become a footnote.

But how is that fundamentally different from the high-flying world of crypto? It ain’t. It's the same game, just with better branding and bigger numbers. One is a grimy back-alley craps game; the other is a glitzy, high-roller room at a Las Vegas online casino casino.us where the pit boss is friends with the president. In both cases, someone has inside information, someone is placing a bet, and someone is hoping to get rich off a system they know how to game.

The difference is scale and, offcourse, legitimacy. The guys betting on basketball games are criminals. The guys building a multi-billion dollar, unregulated financial system and then getting pardoned for it are... innovators? Visionaries? It’s a joke. We’re living in a world where the punishment for a crime is directly proportional to how little money you made committing it.

Then again, maybe I'm the one who's out of touch. Maybe this is just the logical endpoint of the "move fast and break things" ethos Silicon Valley has been selling us for two decades. They finally broke something so big—the concept of equal justice—that they needed the most powerful man in the world to sweep up the pieces. And the market just shrugs and keeps climbing. What does that say about us?

The House Always Wins

Look, let's be real. This was never about technology, or decentralization, or banking the unbanked. That was all just marketing copy for the brochure. It's always been about creating a new, unregulated playground for the rich to get richer, completely disconnected from the old rules that the rest of us still have to follow. The pardon isn't a bug in the system; it's the ultimate feature. It’s the final confirmation that if you have enough money and enough influence, the law is just a suggestion. And all the analysts and experts can talk about "supply shocks" and "bullish indicators" all they want, but they’re missing the point. The most bullish indicator of all just happened: the system officially confirmed it will protect its own, no matter what.