Article Directory

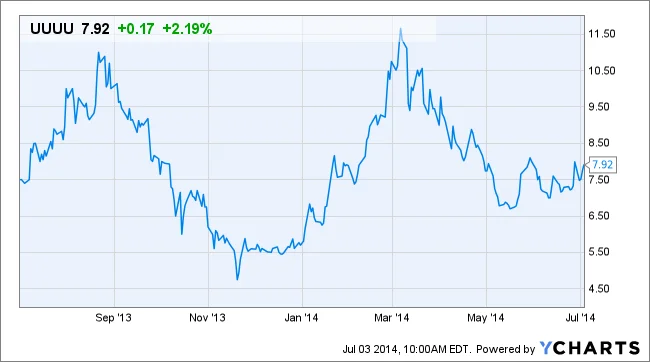

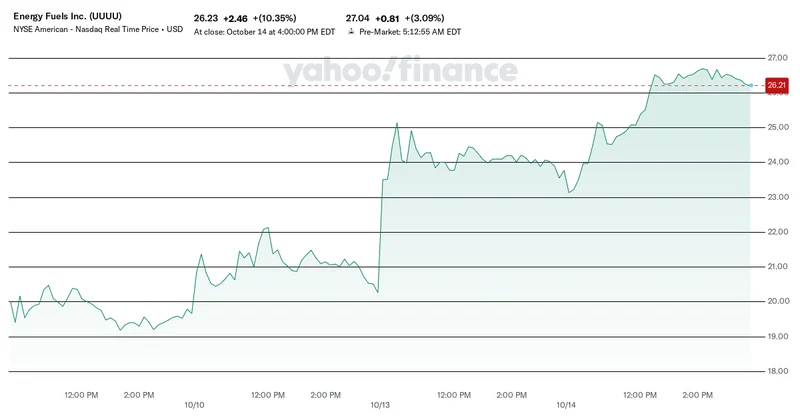

I’ve been watching the markets for a long time, and every so often, a stock ticker doesn't just flicker—it sends up a flare. This past week, that flare came from a company called Energy Fuels, ticker symbol UUUU. The stock went on an absolute tear, surging to all-time highs on news that felt ripped from a geopolitical thriller. Most of the headlines you'll see, like Why Energy Fuels Stock Exploded Higher Today, will be about the money, the percentages, the pre-market frenzy. But I'm telling you, that’s not the real story.

What we're witnessing isn't just a stock rally. It’s a tremor, a seismic signal that a tectonic shift in the global order of technology is finally, violently, underway. For decades, we’ve built our glittering technological future—from the iPhone in your pocket to the F-35 fighter jet—on a foundation we didn't own. Now, the landlord is threatening to change the locks, and we're scrambling to build our own house. This is the story of that frantic, necessary, and ultimately inspiring construction.

The Dragon's Chokehold

Let's get one thing straight: "rare earths" are not rare. They're just incredibly difficult to process, and for the last thirty years, one country has ruthlessly cornered the market: China. Beijing controls over 90% of the global supply of these processed critical minerals.

Imagine if a single company in a single town made every screw, nut, and bolt on the planet. Every car, every skyscraper, every circuit board would depend on the whims of that one supplier. That is the situation we've allowed to happen with the essential ingredients of modern technology. These aren't just rocks; they are the elements that create the powerful magnets in EV motors and wind turbines, the phosphors in our screens, and the guidance systems in our defense technology.

When China announced in early October it was tightening export controls on five more of these elements, it wasn't just a policy change; it was a shot across the bow. It was a demonstration of power. You could almost hear the collective gasp in boardrooms and government offices from Washington to Brussels. JPMorgan's CEO Jamie Dimon put it bluntly, saying it’s "painfully clear" the U.S. has become "too reliant on unreliable sources."

This is the kind of vulnerability that keeps strategists up at night. For years, it was a theoretical problem, a line item in a dusty Department of Defense report. But now, it’s real. The leash is being tugged. The question is no longer if we need our own supply chain, but how on earth do we build one, and how fast?

An Oasis in the Utah Desert

This is where our story pivots to a place called the White Mesa Mill in Blanding, Utah. Standing there, amidst the stark beauty of the desert, you can feel the hum of a different kind of future being forged. This facility, run by Energy Fuels, is the only fully licensed and operating conventional uranium and rare earths processing plant in the entire Western Hemisphere.

Let that sink in. In the entire West, this is it.

For years, Energy Fuels was known primarily as America's leading uranium miner, a crucial player in the coming nuclear energy renaissance. But they saw the writing on the wall. They began retrofitting their mill to do what almost no one else outside of China could: take raw monazite sands and separate them into the specific rare-earth oxides needed for high-tech manufacturing. We’re talking about things like neodymium-praseodymium (NdPr) oxide—in simpler terms, it's the secret sauce for the world's most powerful magnets.

When I read the news that they had successfully taken the material processed at their Utah mill and had it turned into high-performance EV motor magnets, I honestly just sat back in my chair. This is the kind of breakthrough—the kind that sparks headlines like Energy Fuels (UUUU) Stock SKYROCKETS on Rare-Earth Breakthrough – Uranium Bull Run Ignited?—that reminds me why I got into this field in the first place. It’s a proof of concept that closes the loop. It’s the "mine-to-magnet" strategy that CEO Mark Chalmers talks about, and seeing it happen, seeing an American company on American soil demonstrate this capability—it’s a decisive moment.

They're not just pulling minerals out of the ground. They are building the intellectual and industrial muscle to create a parallel supply chain, one that answers to us. This dual-threat capability—powering our future with clean nuclear energy while also supplying the materials for our advanced technology—is an incredibly powerful combination. But does this one facility, this one company, have what it takes to break a decades-long dependency? And can it be done before the leash gets pulled even tighter?

Valuing a Revolution

Naturally, Wall Street is having a hard time figuring this out. You see analysts at B. Riley doubling their price target to $22, while the consensus from others languishes below $12. You hear warnings that the stock is "extremely overbought" and that the company "isn't consistently profitable," pointing to a Q2 loss of nearly $22 million.

And you know what? On paper, they're right. If you look at Energy Fuels through the narrow lens of a quarterly earnings report, it looks like a risky, speculative bet.

But this is like trying to value the first printing press in 1450 by calculating its scrap metal value. It completely misses the paradigm shift it represents. We are not valuing a company based on its past profits; we are valuing the necessity of its mission. The market isn't just buying a stock; it's buying a strategic asset. It's investing in technological sovereignty. This surge isn't just about a few headlines and some geopolitical posturing, it's about the dawning realization that we need to rebuild our entire industrial base for critical technologies and the money is finally, finally starting to flow.

The real question isn't whether Energy Fuels can turn a profit next quarter. The real question is: what is the price of not having this capability? What is the cost of letting a single geopolitical rival hold the keys to our entire technological and defense infrastructure? When you frame it that way, the risk isn't in the investment; the risk is in the inaction. This is the messy, volatile, and exhilarating process of a new industry being born out of sheer necessity.

We're Building the Scaffolding of Tomorrow

Let's be clear. This isn't just a financial story. This is a story about resilience. For decades, we chased efficiency above all else, creating brittle, hyper-optimized supply chains that could shatter with a single political decision. The shock we're feeling now is the pain of that realization. But that pain is productive. It's forcing us to build something better, something more robust and decentralized. The wild ride of Energy Fuels' stock is simply the most visible manifestation of this deep, underlying shift. We are witnessing the first blueprints being drawn for a new, independent technological future. And it's about time.