Article Directory

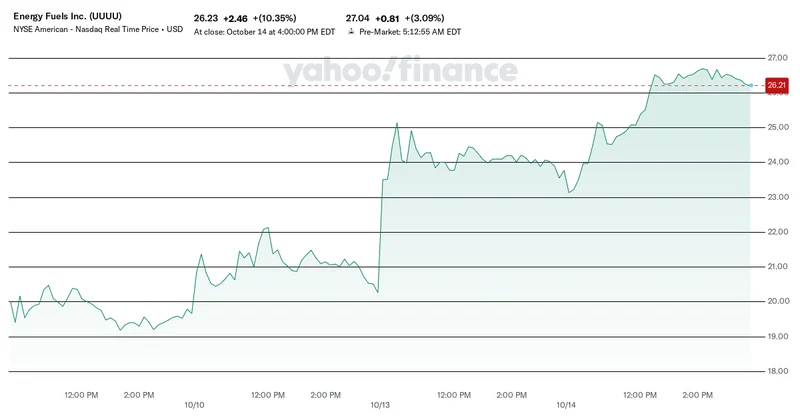

So, let me get this straight. China rattles its saber about rare-earth minerals—the secret sauce in everything from iPhones to F-35s—and a money-losing uranium miner from Colorado sees its stock price go completely vertical. Shares of Energy Fuels, ticker UUUU, shot up over 18% on Monday because of a geopolitical staredown. This is the world we live in now. A world where a press release from Beijing or a late-night tweet from Donald Trump can mint millionaires before breakfast.

The whole thing is a circus. Trump, in classic form, tells everyone "Don't worry about China, it will all be fine!" as if he's calming a nervous puppy. Meanwhile, Jamie Dimon, a man who probably has money woven into his pajamas, is out there talking about our "painfully clear" reliance on unreliable sources. No kidding, Jamie. We’ve only been outsourcing our entire industrial base for 30 years. Thanks for the update. The market, of course, eats it all up. Fear, reassurance, rinse, repeat. It’s like a Pavlovian response for Wall Street traders, and the bell they’re salivating for is geopolitical chaos.

This isn’t investing. This is a high-stakes guessing game, and Energy Fuels is the lottery ticket everyone's suddenly clutching. A company with a $5 billion market cap but only about $65 million in trailing revenue and a net loss of nearly $100 million. Do the math. It makes no sense. This is a story stock, a meme stock with a geopolitical narrative. It's a bet that America's decades of strategic malpractice will be so profitable for the one or two companies left standing that none of the fundamentals matter. And honestly... maybe they're right.

The Only Game in Town (For Now)

Let’s be real. The reason UUUU is exploding isn't because it's a revolutionary company. It’s because it’s basically the only game in town. They own the White Mesa Mill in Utah, the only licensed conventional uranium mill in the entire United States. That’s not a business model; that’s a strategic asset by default. It’s like owning the only gas station for 500 miles. You don’t have to be good, you just have to be there.

And they’re trying to be there for rare earths, too. They’re running pilots, producing 99.9% pure dysprosium oxide, and making EV magnets. CEO Mark Chalmers calls it a “decisive breakthrough in building a supply chain independent of China.” A "decisive breakthrough"? Give me a break. It's a great step, a necessary one, but let's not pretend this little pilot program in Utah is going to replace the decades-long, state-sponsored industrial machine that China has built. We're talking about a country that processes 90% of the world's rare-earth magnets. Energy Fuels’ rare-earth revenue so far? Less than $5 million. It’s a rounding error.

This is a bad sign. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of a national security problem. Our entire green energy transition and defense industrial base is utterly dependent on a geopolitical rival. So when China even hints at turning off the tap, we panic and throw money at the first domestic company that has a PowerPoint deck on the topic. Is this really the plan? Are we just going to hope this one company, with its negative gross margins and massive cash burn, can solve a crisis that was 30 years in the making?

The company just raised $700 million in convertible debt, which sounds impressive until you realize they’re burning through cash like a tech startup in 1999. They say it gives them six years to reach profitability. Six years? In this market, six years is an eternity. By then, we could have a trade detente with China, or find a new wonder material, or just get distracted by the next shiny object. It reminds me of my cousin who keeps buying workout equipment. He's got all the gear to get in shape, but he ain't actually doing it. Energy Fuels has the mill and the mines, but the profits are still just a New Year's resolution.

A Ticking Short Squeeze Bomb

If you want to know how divorced from reality this all is, just look at the short interest. It’s sitting at a whopping 13.5% of the float. That means a huge number of professional traders are betting this thing is going to crash and burn. Ordinarily, that's a massive red flag. But in the upside-down logic of today's market, it’s a feature, not a bug. The bulls see that high short interest and start drooling over the possibility of a massive short squeeze.

It's a feedback loop of pure speculation. The stock goes up because of a China headline. The shorts get nervous. The bulls pile in, hoping to make the shorts panic and buy back their shares at any price, which pushes the stock even higher. The actual business of mining uranium or processing minerals becomes a footnote. The stock is no longer a reflection of the company's value; it's a weapon in a war between two camps of gamblers.

And what happens when the headlines fade? What happens when Trump and Xi have their meeting, smile for the cameras, and announce some vague agreement? The geopolitical premium vanishes overnight. All the tourists who piled in on the rare-earth hype will run for the exits, and the people left holding the bag will be the ones who actually believed the story.

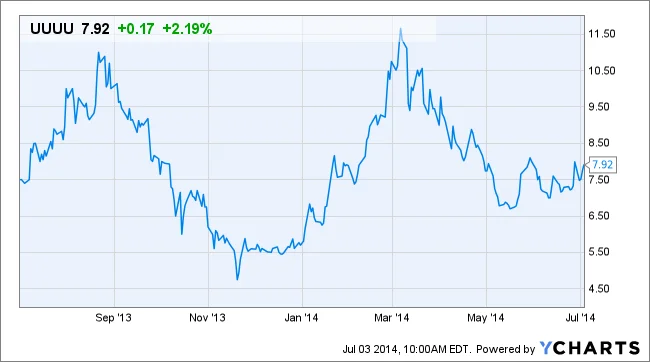

Then again, maybe I'm just too cynical. Maybe this time is different. Maybe our total strategic dependance on China is finally the catalyst that forces us to rebuild a real industrial base, and Energy Fuels will be the cornerstone of it all. But what are the odds of that versus the odds that this is just another pump-and-dump scheme wrapped in an American flag? I know where I'd place my bet.

This Whole Thing Is a Casino

Look, I'm not a financial advisor, and this sure as hell isn't advice. But what I see here isn't an investment; it's a bet on fear. It's a bet that the geopolitical tension with China will only get worse, forcing the U.S. government to prop up companies like Energy Fuels with subsidies, contracts, and stockpiling programs. The stock isn't trading on its ability to generate profit, but on its proximity to a crisis. It's a beautifully cynical play, and for now, it's working. But let's not pretend it's anything other than what it is: a speculation on disaster. And in that game, the house always wins eventually.