Article Directory

You’ve seen the headlines, haven’t you? VIX Spikes Above 20 After Trump's Tariff Threats, or the even more breathless, VIX News Today: Volatility Index Surges 100% as Global Markets Face Uncertainty. It’s designed to make your heart pound, to make you picture frantic traders on a floor that doesn’t even really exist anymore, shouting into phones as red numbers cascade down a screen. The CBOE Volatility Index, the VIX index, is Wall Street’s official boogeyman, its "fear gauge." When it jumps, we’re all supposed to jump with it.

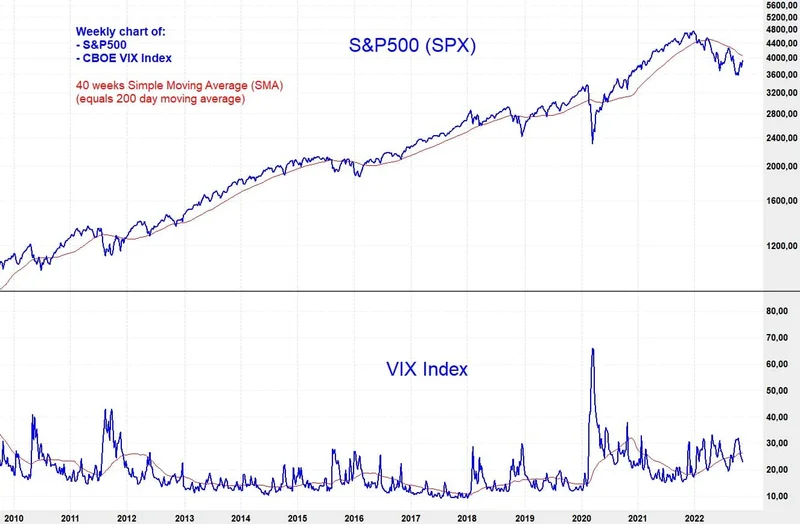

And lately, it’s been jumping a lot. A stray presidential tweet about tariffs sends it soaring. Geopolitical tensions in Eastern Europe or the Middle East? The VIX price rockets up. Stubborn inflation fears? It climbs from a placid 16 to a panicked 22 in the blink of an eye. The entire financial media machine, from VIX TV segments to push alerts from your favorite VIX app, is built to amplify this single number. It’s a measure of implied volatility—in simpler terms, it's a number that tries to bottle the lightning of collective market anxiety.

But what if we’re looking at it all wrong? What if this vaunted fear gauge isn't a sophisticated barometer of market health, but a primitive, twitching nerve ending in a system that’s long overdue for a new brain?

When I first read the headline ‘VIX Surges 100%’, I didn’t feel fear. I honestly felt a surge of validation, because this is the kind of chaotic, unpredictable signal that proves the old systems are failing. We’re using a 20th-century tool to measure a 21st-century storm, and it’s telling us what we already know: it’s turbulent out there. But is that really the most useful piece of information we can have? Is the goal simply to measure our collective panic with ever-increasing precision? Or is it to build something better?

The Fever Chart of a Failing System

Let’s be clear about what the VIX today really is. It’s an elegant piece of financial engineering, derived from the prices of S&P 500 options. It’s a snapshot of how much traders are willing to pay for insurance against market swings. When they’re scared, they pay more. The VIX goes up. It’s a brilliant reflection of emotion. But that’s all it is—a reflection.

Using the VIX to navigate the market is like trying to navigate a hurricane by holding up a wet finger to the wind. It tells you which way the gale is blowing right now, but it gives you zero insight into the storm’s path, its underlying atmospheric pressures, or where the eye of tranquility might be. It’s reactive, not predictive. It’s a symptom, not a diagnosis. We see it in the frantic trading of instruments meant to surf this chaos, from VIX futures to the popular SPY and QQQ ETFs, all moving in response to this singular, emotional number.

This recent surge, driven by a cocktail of global instability and economic jitters, highlights the system's core flaw. It treats fear as an irreducible force of nature, a market fundamental as real as earnings or interest rates. This is a profound error in thinking, a bit like the alchemists of old. They saw the world as a place of mysterious essences and spirits, and they spent their lives trying to transmute lead into gold through ritual and guesswork. The VIX is our modern alchemy—a complex formula designed to quantify an emotion.

But what happens when we stop trying to quantify fear and start trying to understand—and even predict—the complex systems that generate it? What happens when we move from financial alchemy to real economic science?

A New Kind of Signal

This is where I get incredibly excited. Because for the first time in history, we have the tools to move beyond these primitive signals. We are building the economic equivalent of satellite weather imaging and predictive climate modeling. I’m talking about the nexus of artificial intelligence, massive datasets, and predictive analytics.

Imagine, for a moment, a system that doesn’t just look at options pricing. Imagine a system that ingests global shipping data in real-time. That analyzes the sentiment of millions of corporate filings, news articles, and social media posts, not just for keywords, but for nuanced shifts in tone. A system that models supply chain vulnerabilities, geopolitical risk factors, and consumer behavior shifts before they congeal into a headline that sends the VIX soaring. This isn't just about a better VIX ETF or a smarter trading algorithm—it's about rewiring our entire economic nervous system to run on predictive intelligence instead of reactive panic and that's a paradigm shift so profound it’s hard to even wrap your head around.

This isn’t science fiction; the foundations are being laid right now. We’re moving from a world of lagging indicators to one of leading intelligence. The VIX tells you the herd is stampeding. This new generation of tools can tell you why the herd got spooked, where it's likely to run next, and how to build a stronger fence in the first place. I saw a comment on a forum the other day that just nailed it: “The VIX measures how loudly the dinosaurs are roaring. We’re busy building the spaceships.” That’s exactly it.

Of course, with this power comes immense responsibility. We must be vigilant that these predictive systems don’t create new, invisible forms of systemic risk or become self-fulfilling prophecies that amplify bias. The goal isn't to create a cold, deterministic machine, but to provide humanity with better tools for understanding, for foresight, and for building more resilient, adaptable economic structures. Can we build systems that empower, rather than just predict? That’s the ethical tightrope we have to walk.

The next time you see a headline about the VIX stock price (which, by the way, isn't a stock, but that's a common misconception) spiking, I want you to see it not as a sign of impending doom, but as a distress signal from an old and outdated way of thinking. It’s the roar of a dinosaur, loud and terrifying, but ultimately a sound from a bygone era. The future isn't about getting better at measuring fear. It's about building a world with less to be afraid of.

Beyond Fear, Towards Foresight

The VIX is a masterpiece of 20th-century thinking: a tool to measure a problem. But the 21st-century challenge isn't to measure our anxiety with greater precision; it's to architect systems that generate clarity and confidence. The headlines will keep screaming about fear, but the real story, the one that truly matters for our future, is being written quietly in the language of data, code, and predictive intelligence. We're on the cusp of trading the fear gauge for a foresight engine, and that changes everything.