Article Directory

A $4.8 Million Bet on QQQ: Is This Wealth Fund Seeing a Seasonal Windfall or Just Chasing Yesterday's Tech Rally?

Institutional money moves for a reason, but rarely is the reason as simple as the headlines suggest. When a 13F filing hits the wire showing a wealth manager, DKM Wealth Management, Inc., just initiated a new position in the Invesco QQQ Trust to the tune of $4.8 million, the retail world takes notice. The signal appears clear: a professional firm with $124.58 million in assets is making a significant, bullish bet on the Nasdaq 100.

The surface-level data certainly supports a bull case. The QQQ is up a healthy 18.7% year-to-date, buoyed by dovish Fed minutes and the relentless momentum of tech behemoths like Nvidia. The consensus among Wall Street analysts, according to TipRanks, is a “Moderate Buy,” with a price target implying another 8.7% of upside. For many, that’s enough. They see the big institutional buy—spurred on by headlines like DKM Loads Up on QQQ With 7,900 Shares Worth $4.8 Million—they see the positive numbers, and they follow the money.

But that’s a dangerously simplistic reading of the tape. I've looked at hundreds of these filings, and a new position of this size (3.8% of the fund’s entire U.S. equity portfolio) is never just about chasing momentum. It’s a calculated decision, and the real story isn't in the headline number, but in the timing and the instrument chosen. Is this a high-conviction bet on the future of tech, or is it something else entirely—a tactical, short-term play on a predictable pattern? The data underneath the hood suggests the latter.

The Contradiction in the Code

Before mirroring a move like DKM’s, it’s critical to look at the less-publicized metrics. While analysts are calling QQQ a “Moderate Buy,” the ETF’s own Smart Score is a 7 out of 10. That number isn’t terrible, but it implies the fund is "likely to perform in line with the broader market." Let that sink in. The very structure of the fund suggests it’s not poised for exceptional outperformance, but rather for average, market-tracking returns. This is the first major discrepancy. If the quantitative outlook is merely average, why are both analysts and funds like DKM acting so bullish?

This is where we must separate the vehicle from the journey. DKM didn’t just buy “tech”; they specifically bought the QQQ. They could have chosen its very similar, lower-cost cousin, QQQM, which is designed for long-term buy-and-hold investors. They didn’t. They chose QQQ, known for its massive liquidity and higher expense ratio, making it a preferred tool for active traders and institutions that need to move in and out of positions efficiently. This choice of instrument is a tell. It whispers that this might not be a permanent portfolio addition, but rather a rental.

This brings us to the timing. The purchase was made in Q3 2025, which ended September 30th. For anyone who tracks market seasonality, that date is a flashing neon sign. September is, historically, the single worst-performing month for the Nasdaq 100. Following this predictable dip, however, is what some traders call the “winter tech rally.” The data is unambiguous: the five-month stretch from November through March has consistently been the strongest period for QQQ over the last 15 years.

DKM's purchase, then, looks less like a reaction to recent news and more like a textbook setup for a seasonal trade. They're not buying the top; they're buying after the historical seasonal bottom, positioning themselves perfectly for the historical seasonal peak. It’s like a farmer buying seeds after the last frost, not because the weather is perfect today, but because the calendar says the growing season is about to begin. It's a probabilistic bet on a recurring pattern, not a fundamental analysis of every company in the index. It's a textbook example of how to Use Seasonal Returns to Find Better Trades, from GLD to QQQ. But does a pattern, no matter how consistent, guarantee a future outcome in today's volatile market?

Trading the Calendar, Not the Company

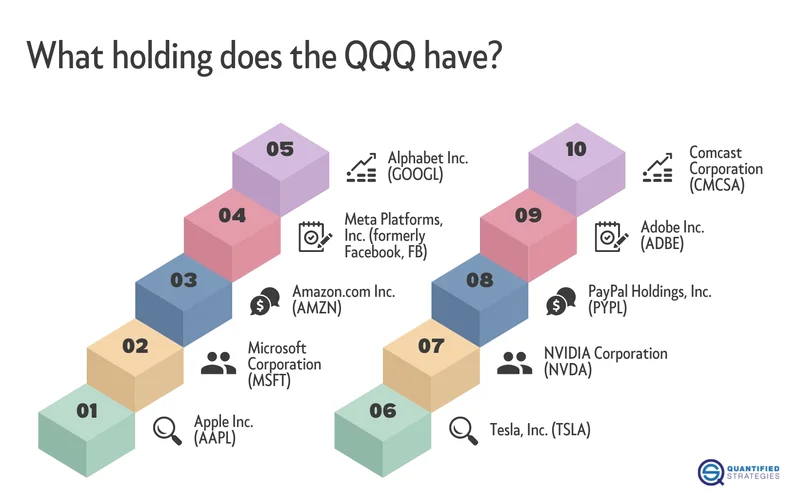

This seasonal perspective reframes DKM’s entire $4.8 million allocation. It’s not a vote of confidence in every one of the 100 companies in the QQQ. After all, the ETF’s own holdings paint a messy picture. For every holding with high upside potential like MicroStrategy or Atlassian, there’s another with significant downside risk, like Intel or Tesla. An ETF, by its nature, is a basket of compromises. You get the good with the bad, and the result is often, well, average—just as the Smart Score suggests.

So, the play here isn't about picking winners. It's about riding a powerful tide that historically lifts all boats in the Nasdaq harbor, at least for a few months. DKM isn’t betting that Tim Cook or Jensen Huang will unveil a revolutionary new product in Q4. They're betting that holiday sales cycles, fourth-quarter institutional window dressing, and positive earnings optimism will align, as they so often have, to create a tailwind for tech stocks. The total YTD return is impressive, around 24%—or to be more exact, 23.84% through October 9, outperforming the S&P 500 significantly. But following that performance now, in mid-October, without understanding the seasonal context, is like arriving at a party just as the hosts are starting to clean up.

This is the critical distinction for any investor watching these moves. Are you investing with a multi-year horizon based on a fundamental belief in innovation, or are you trading a three-to-five-month window based on historical data? Both can be valid strategies, but they are not the same. Mistaking a short-term tactical trade for a long-term strategic endorsement is one of the fastest ways to get burned. The question DKM’s filing forces us to ask is not whether tech is a good bet, but for how long? And what’s your plan when the calendar turns to April, historically a far more volatile month?

It's a Calendar Play, Not a Conviction

Let’s be perfectly clear. DKM Wealth Management’s purchase of QQQ is likely a sharp, data-driven trade. It is not, however, a profound statement on the intrinsic value of the Nasdaq 100 for the long-term holder. They used a liquid, trader-friendly vehicle to position themselves for the most historically reliable seasonal updraft in the entire market. This is a smart, probabilistic move. But it's a trade, not an investment. Following them into QQQ without a clear exit strategy based on that same seasonal logic is simply chasing performance and ignoring the very data that likely drove their decision in the first place. The real signal here isn't "buy tech," it's "mind the calendar."