Article Directory

It’s easy to get lost in the noise. You see the ticker flash red—a sea of down arrows on a day when everything seems to be sinking. For Rocket Lab (RKLB), the most recent session closed with a loss of 3.25%. Your gut reaction is probably caution, maybe even a flicker of panic. The stock lagged the S&P 500, which only shed 2.71%. In the unforgiving world of daily market movements, that’s underperformance. Plain and simple.

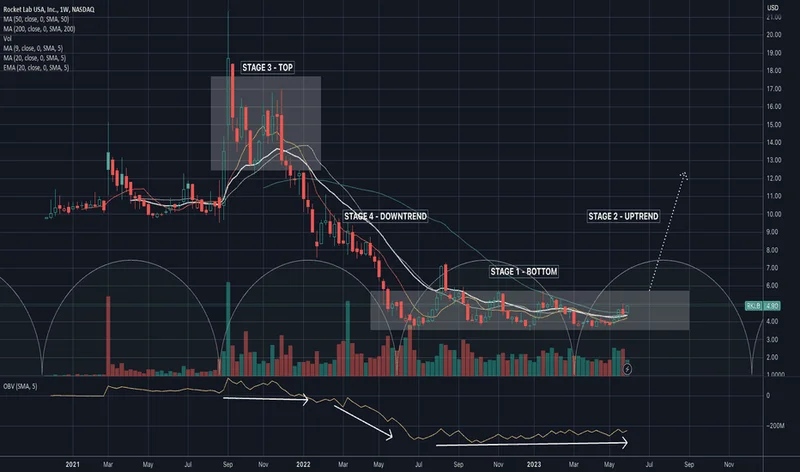

But fixating on a single day’s trading is like judging a marathon runner’s entire race by a single stumble at mile 18. It’s a data point, certainly, but it’s stripped of all context. It tells you what happened, but it tells you nothing about where things are going. When you pull back the lens, the picture for Rocket Lab doesn’t just change; it inverts. That 3.25% drop is set against a staggering 37.15% gain over the past month. Let that sink in. While the broader S&P 500 was clawing its way to a 3.5% gain and the Aerospace sector managed a respectable 5.34%, Rocket Lab was in a different stratosphere.

This is the classic disconnect that separates short-term traders from long-term investors. One group is reacting to the intraday static, the other is trying to tune into the underlying signal. And right now, the signal for RKLB appears to be coming in loud and clear, suggesting that today’s dip might be nothing more than turbulence on the way to a higher altitude. The real question isn't why it dropped today, but whether the fundamental story that propelled it up 37% is still intact.

The Anatomy of an Upgrade

To find that signal, you have to ignore the price chart for a moment and look at the expectations engine that truly drives Wall Street: analyst estimates. This is where the narrative shifts from emotional reaction to cold, hard numbers. The market is forward-looking, and the consensus estimates for Rocket Lab paint a picture of aggressive, accelerating growth.

The company is expected to post an earnings per share of -$0.05 in its upcoming report. On the surface, a negative number seems poor, but context is everything. This represents a 50% improvement from the same quarter last year. The bleeding is slowing, and the path to profitability is becoming clearer. More importantly, revenue is forecast at $151.32 million, a 44.37% surge year-over-year. This isn't just growth; it's the kind of top-line expansion that gets institutional money to sit up and pay attention.

I've looked at hundreds of these consensus reports, and this is the part of the analysis that I find most compelling. It’s not just one strong quarter being priced in. The full-year estimates project a 35% revenue jump to $589 million and an earnings improvement of about 37%—to be more exact, 36.84%. These aren't my numbers; they are the aggregated projections of the analysts paid to do nothing but model this company's future.

And those analysts are becoming more bullish, not less. Over the last 30 days, the Zacks Consensus EPS estimate has moved 6.02% higher. This is a critical detail. It means that as new information has come to light, the experts have systematically revised their profit expectations upward. This is the engine behind the company’s Zacks Rank #2 (Buy) rating. These ratings aren't arbitrary; they are quantitative models built on the principle that positive earnings estimate revisions have a strong correlation with future stock performance. In a market obsessed with "what's next," this is a powerful leading indicator. So, where is the disconnect? Is the market punishing all tech indiscriminately on a bad day, or is there a specific, unreported concern that these analyst models are somehow missing?

A Rising Tide in a Premium Sector

A company, no matter how strong, doesn't operate in a vacuum. It exists within an industry, and that industry's health can provide powerful tailwinds or headwinds. For Rocket Lab, the wind is at its back. The Aerospace - Defense Equipment industry currently holds a Zacks Industry Rank of 52. That places it in the top 22% of over 250 industries tracked.

This isn’t just a trivial piece of data. Research consistently shows that about half of a stock's price movement can be attributed to the strength of its industry group. The fact that Rocket Lab is a well-regarded player (with a "Buy" rating) inside a top-quartile industry is a potent combination. It suggests that the company isn't just a lone wolf executing well; it's a leader in a sector that itself is outperforming.

When you combine the company-specific fundamentals—rapid revenue growth, improving profitability, and upward estimate revisions—with the macro tailwind of a strong industry, the 3.25% one-day drop starts to look less like a warning sign and more like a potential opportunity. The market sold off, and high-beta growth names like RKLB often get sold off harder. That’s the simple, mechanical explanation. The deeper, more analytical story, however, seems to be one of fundamental strength temporarily obscured by market-wide fear. The numbers are pointing in one direction, even if the daily price chart briefly pointed in another.

The Trend Line Isn't Straight

Let's be clear. The single-day drop is real. It happened. But mistaking that volatility for a change in the fundamental verdict is a classic analytical error. The data points that matter for a growth company like Rocket Lab are almost all forward-looking: revenue acceleration, margin improvement, and the direction of analyst estimates. On all three counts, the underlying metrics remain robust. The 37% run-up in a month was the market pricing in this optimistic future. The 3% drop was the market having a bad day. One is a reflection of the company's trajectory; the other is a reflection of algorithmic trading and macro anxiety. The core story here isn't about a single day of underperformance, but about whether you trust the long-term signal more than the short-term noise. Based on the numbers, the signal is still strong.