Article Directory

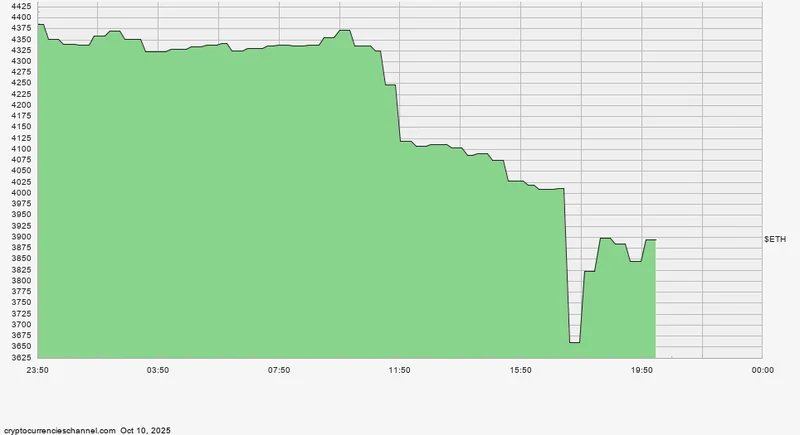

The recent 6% slide in Ethereum's price, sending it skittering down to test the $4,100 support level, isn't just another bout of random market volatility. While the charts show a predictable cascade of over $237 million in 24-hour liquidations and a technical battle brewing at the 100-day moving average, the real story isn't in the price action. It's in the autopsy report of a corporate strategy that's now failing in real-time.

The Key Reason Why Ethereum (ETH) Price Just Crashed was a clinical, cutting report from Kerrisdale Capital, announcing its short position on BitMine Immersion (BMNR), an Ethereum treasury firm. But this isn't just about one company. Kerrisdale's thesis is a direct assault on the entire corporate crypto treasury model, a playbook popularized by MicroStrategy and its `bitcoin` evangelist CEO, Michael Saylor. The core argument is simple and devastating: the strategy "no longer works."

And when you look at the numbers, it's hard to argue they're wrong.

The Broken Flywheel

The corporate crypto treasury model was, for a time, a brilliant piece of financial engineering. It worked like a flywheel: a company buys a significant amount of a digital asset (like `bitcoin` or Ethereum), investors get excited by the direct exposure, and they bid up the company's stock to a premium over its net asset value (NAV). The company then uses its inflated stock price to issue more shares or raise debt, using the proceeds to buy even more crypto. The cycle repeats, spinning faster and faster.

It was a strategy built on reflexivity, scarcity, and charisma. MicroStrategy had Michael Saylor, a "meme-stock icon" who could command a cult-like following to sustain the narrative. But more importantly, it operated in an environment where direct, regulated exposure to crypto was difficult for many funds and individuals to obtain. The company became a convenient, if expensive, proxy.

That era is over. Kerrisdale’s analysis of BitMine lays the decay bare. The firm points out that while BitMine touts its growing ETH holdings, the more critical metric—ETH-per-share—is seeing its growth rate plummet. Why? Because the company is issuing stock so aggressively that it's diluting existing shareholders faster than it's acquiring assets. The initial investor excitement has curdled into fatigue; every rally is now seen as a prelude to another wave of supply hitting the market. Their recent $365 million direct offering was framed as "materially accretive" (a term that should always raise an eyebrow), but the market is clearly interpreting it as a cash grab that prioritizes short-term liquidity over long-term credibility.

This entire model is like a musician who became a sensation by playing a completely new genre of music. In the beginning, they were the only act in town, and fans would pay a massive premium just to get in the door. Now, however, the market is flooded. The arrival of spot `bitcoin` and Ethereum ETFs has created a dozen other, cheaper, and more efficient ways to hear the same song. The scarcity that justified the premium is gone. Why would an investor pay a 1.5x premium for BMNR or MicroStrategy when they can buy a spot ETF with a management fee under 0.5%?

The data shows the premium is collapsing across the board. MicroStrategy's premium has already fallen from its highs of around 2.5x NAV to below 1.5x. BitMine's is compressing, too. The flywheel is grinding to a halt because its essential fuel—market scarcity—has been refined out of existence.

A Narrative Under Pressure

When a core market narrative breaks, the effects are never isolated. The Kerrisdale report on BMNR acted as a pinprick on a much larger balloon of anxiety. The subsequent drop in the `ethereum price usd` and the spike in liquidations weren't just about a single short report. They were about the market suddenly being forced to re-evaluate every company built on this now-questionable foundation.

I've looked at hundreds of these short reports over the years, and what stands out here isn't just the financial analysis. It's the critique of the narrative itself. Kerrisdale isn't just shorting a balance sheet; they're shorting a story that the market is starting to doubt. They explicitly call out the difference in leadership, noting BitMine's chairman, Thomas Lee, lacks the "cult-like appeal" of Saylor. This isn't just color; it's a quantitative assessment of a key variable in a reflexivity-driven strategy. Without a charismatic leader to keep the faith, the model is just a dilutive, inefficient, and expensive proxy for holding ETH.

Of course, other macro factors are at play. Renewed trade tensions between the U.S. and China are rattling the broader markets, and some analysts believe the sell-off is a temporary overreaction. But that feels like noise. The signal is the targeted, data-driven dismantling of a popular crypto investment thesis. The market is now looking at a row of dominoes, and Kerrisdale just tipped over the first one.

This leaves us with some critical, unanswered questions. How many other companies are quietly relying on this same playbook, hoping the market doesn't notice their own slowing asset-per-share metrics? And are their balance sheets prepared for a world where the NAV premium doesn't just shrink, but disappears entirely, or even becomes a discount? The technical charts are pointing to a potential drop to $3,500 for ETH if the 100-day SMA is lost. That's not a prediction, but it is a measure of the market's current fragility. A drop of that magnitude—about 15%, or to be more exact, 14.6% from the current level—could put serious pressure on the balance sheets of these corporate treasuries.

The Arbitrage Has Closed

Let's be clear. The corporate crypto treasury strategy wasn't a scam; it was a brilliant arbitrage of market structure and investor sentiment. For a brief period, it offered a solution to a real problem: a lack of accessible, regulated crypto investment vehicles. But that period is definitively over. The launch of spot ETFs was the closing bell on that arbitrage. What's left is a collection of companies that are, in essence, less efficient, more expensive, and more dilutive closed-end funds. The premium they once commanded was a fee for access. Now that access is virtually free, the fee is going to zero. The market is just beginning to price in that new reality, and the recent turbulence in both `bmnr stock` and the broader `ethereum price today` is the first, painful step in that repricing. The model is broken, and the smart money knows it.