Article Directory

Let's get one thing straight. When a stock that was circling the drain, trading for literal pocket change, suddenly rockets up 305% in a week, you don’t ask "What's the good news?" You ask "What's the catch?"

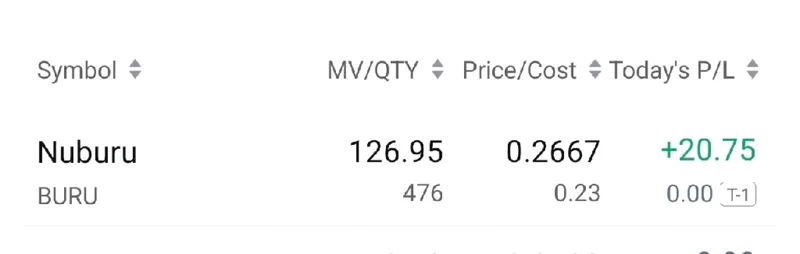

Nuburu (BURU), a company that makes high-powered blue lasers—something that sounds like it belongs in a Bond villain’s lair—just became the darling of the day-trading world. The stock went from 12 cents to nearly 70 cents in the blink of an eye, leaving many to ask, Why Is Nuburu Stock (BURU) Up over 30% In Pre-Market Today? The official story? A "strategic acquisition" to build out a new "Defense & Security Hub."

Give me a break.

We’ve seen this movie a thousand times. A struggling micro-cap company, desperate for a new narrative, announces a deal that sounds impressive on a press release but smells funny if you read it twice. And this one? This one stinks to high heaven.

A Laser Company Buys... Software?

So, what is this game-changing acquisition that sent the stock to the moon? Nuburu’s newly minted subsidiary, Nuburu Defense, is buying an Italian software firm called Orbit S.r.l. Orbit makes "operational resilience" software. That’s corporate-speak for crisis management platforms that help organizations not fall apart when things go sideways. Think of it as a digital playbook for when the power goes out or the servers get hacked.

This is where the first alarm bell starts ringing. Nuburu makes hardware. Lasers. Highly specific, industrial-grade blue lasers. Now, they’re pivoting to become a defense software provider? It’s like a world-class sushi chef suddenly deciding to buy a cattle ranch in Montana to get into the burger business. It's a pivot so sharp it's a U-turn. Can it work? Maybe. But does it feel like a natural, strategic evolution? Absolutely not. It feels like a desperate attempt to slap a fresh coat of paint on a rusty old car.

The company claims this move targets a $3 billion global market serving NATO and other defense agencies. Offcourse it does. Every struggling company is suddenly targeting a multi-billion dollar market. It's the oldest trick in the book. Why this specific software company, though? Why an Italian firm? And is the core laser business so bad that they have to completely reinvent themselves overnight? These are the questions the slick press release conveniently avoids.

The Glaring, Obvious, Five-Alarm Red Flag

Okay, let's get to the real story. The part that makes this whole thing feel less like a strategic masterstroke and more like a carefully orchestrated shell game.

Who owns Orbit S.r.l., the company Nuburu is acquiring? A man named Alessandro Zamboni.

And who is Alessandro Zamboni? He just happens to be the Executive Chairman and Co-CEO of NUBURU.

You read that right. The CEO of Nuburu is using Nuburu's money—well, shareholder money—to buy a company that he himself owns. This is a bad look. No, 'bad look' doesn't cover it—this is a five-alarm dumpster fire of corporate governance.

The press release tries to wave this away, stating the deal was "reviewed by an external financial advisor" and "approved by NUBURU’s independent non-executive directors." I'm sure it was. But that’s like a kid asking his older brother if he can have a third cookie, and the brother saying "sure," right before they both hide the empty cookie jar from their parents. It's technically "approved," but the whole situation is just...icky.

Nuburu is paying up to $12.5 million for a company owned by its own executive. It’s a two-phase deal, starting with a $1.5 million payment for a 10% stake. The rest will be settled in cash and Nuburu stock by the end of 2026. So, not only is the CEO selling his company to his other company, he’s getting a pile of newly-hyped stock as part of the payment. How convenient.

I don't care how many "independent" directors signed off on this. A related-party transaction of this magnitude, especially in a micro-cap company whose stock was on life support, should make any investor run for the hills. But this is 2024, and the market doesn't run from red flags; it sprints toward them, wallets open, chasing the next meme stock high. And the traders who piled in, driving the price up 305%, probably never even read this far into the announcement. They just saw "acquisition," "defense," and a stock ticker with a green arrow next to it. And honestly, maybe I'm the crazy one for even caring about fundamentals anymore.

The company is trying to build a new identity, a "Defense & Security Hub" that combines hardware and software. A noble goal, perhaps. But when the very foundation of that hub is built on a transaction that looks this self-serving, you have to wonder if the whole structure isn't just a house of cards waiting for the slightest breeze. They tell you it’s all about synergy and market opportunity, but when you strip away the jargon, it looks an awful lot like one man's payday. And I just can't shake the feeling that retail investors are the ones who will end up footing the bill.

Smells Like a Shell Game

Let's call this what it is. This isn't a story about a brilliant business pivot. It's a story about financial engineering. It’s about creating a narrative juicy enough to ignite a fire under a dead stock. The acquisition itself, especially the related-party element, is a massive red flag. The CEO is essentially on both sides of the table, a move that rarely benefits the average shareholder. The resulting stock surge feels less like a vote of confidence in a new strategy and more like a speculative frenzy whipped up by a well-timed press release. Maybe it works out, and Nuburu becomes a defense-tech titan. But from where I'm sitting, this looks like a classic case of using a splashy, confusing deal to create hype where none existed. Buyer beware.