Article Directory

So, the DC brain trust is floating another one of its genius ideas: selling off a chunk of the federal student loan portfolio to the highest bidder. The Trump administration is apparently dusting off this zombie of a plan from 2019, a move that has many asking Trump wants to sell some student loans. What if yours is one of them?, and we’re all supposed to pretend it’s some savvy financial maneuver.

Give me a break.

They want you to think this is just like when your mortgage gets sold from one faceless bank to another. You get a letter, you update your autopay, and your life goes on. The official line is that the terms—your interest rate, your monthly payment—all stay the same. It's just a little back-office paperwork.

That's a lie. Not a little white lie, but a big, fat, foundational lie. Comparing a federal student loan to a mortgage is like comparing a rescue dog you adopted from the shelter to a slab of meat at the butcher shop. One comes with a relationship, a set of protections, and a basic understanding of humane treatment. The other is just a commodity to be carved up and sold for profit. And right now, 45 million of us are on the butcher's block.

The Great Student Loan Fire Sale

Let's get one thing straight. The federal government isn't just a lender. It's a lender with unique powers and, theoretically, a different set of motivations. When a global pandemic grinds the world to a halt, the government can hit a giant pause button on payments, like Biden did. When you lose your job, you can get on an income-driven repayment plan that a private bank would laugh you out of the room for even suggesting. These aren't features; they are the entire point of federal lending.

Now, imagine your loan is owned by Vulture Capital Partners, LLC. Picture some guy in a $5,000 suit, staring at a spreadsheet with your name on it, annoyed that you're not generating enough ROI for his quarterly bonus. Do you think he cares about your "extenuating circumstances"? Do you think he's going to offer you forbearance when your car breaks down?

Offcourse not. His only legal and fiduciary duty is to squeeze every last cent out of you for his shareholders. The protections you once had? Gone. The potential for future relief or forgiveness from a different administration? Evaporated. Selling these loans isn't just changing the mailing address for your check; it's fundamentally altering the DNA of the debt itself.

The administration claims this can only happen if it doesn’t cost taxpayers money. This is the part where the plan goes from merely predatory to completely delusional. A 2019 McKinsey analysis—not exactly a bleeding-heart nonprofit—estimated that a staggering 45% of the direct loan portfolio was never expected to be repaid. What private buyer in their right mind would pay full price for an asset that's nearly half junk? They wouldn't. They'd demand a massive discount, and taxpayers would eat the loss. So who, exactly, is this supposed to benefit? It sure ain't the borrowers, and it sure as hell ain't the taxpayers.

So, What's the Catch? Oh, Only Everything.

The sheer absurdity of this plan is what gets me. It’s a solution in search of a problem, wrapped in a layer of fiscal nonsense. The justification seems to be tied into Trump's larger crusade to obliterate the Department of Education, because, as he put it, the department "is not a bank." Well, no kidding. That’s the point. We don't need another bank; we have plenty of those. We need an entity that can manage educational funding without a profit motive breathing down its neck.

This is a bad idea. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of a policy. The experts they trot out to defend this stuff always miss the human element. They talk about portfolios and market value, but they ignore the 45 million people whose financial lives would be thrown into chaos.

And here’s the kicker: to legally sell these loans and strip away the built-in protections (like income-driven repayment or the right to a payment pause), the government might actually have to compensate borrowers for that loss. Think about that for a second. They want to sell the loans to "save money," but they might have to pay out billions to the very people they're screwing over just to make it legal. It's a snake eating its own tail. You couldn't write a more incompetent plot if you tried.

But maybe that’s the real goal. It’s not about money. It’s about making a point. It’s about ensuring that no future administration can ever again offer widespread relief. It’s about permanently locking in the debt, privatizing the profit, and socializing the pain. They want to take the one lifeline millions of people have and hand the rope to a loan shark. And they expect us to believe it’s for our own good, and honestly...

Then again, maybe I'm the crazy one here. Maybe there’s a secret, 4D-chess move I’m just not seeing. But from where I'm sitting, this looks like a plan cooked up by people who have never had to worry about making a student loan payment in their entire lives. What does it feel like to have that kind of disconnect from reality? Is it blissful?

They're Not Selling Debt, They're Selling You

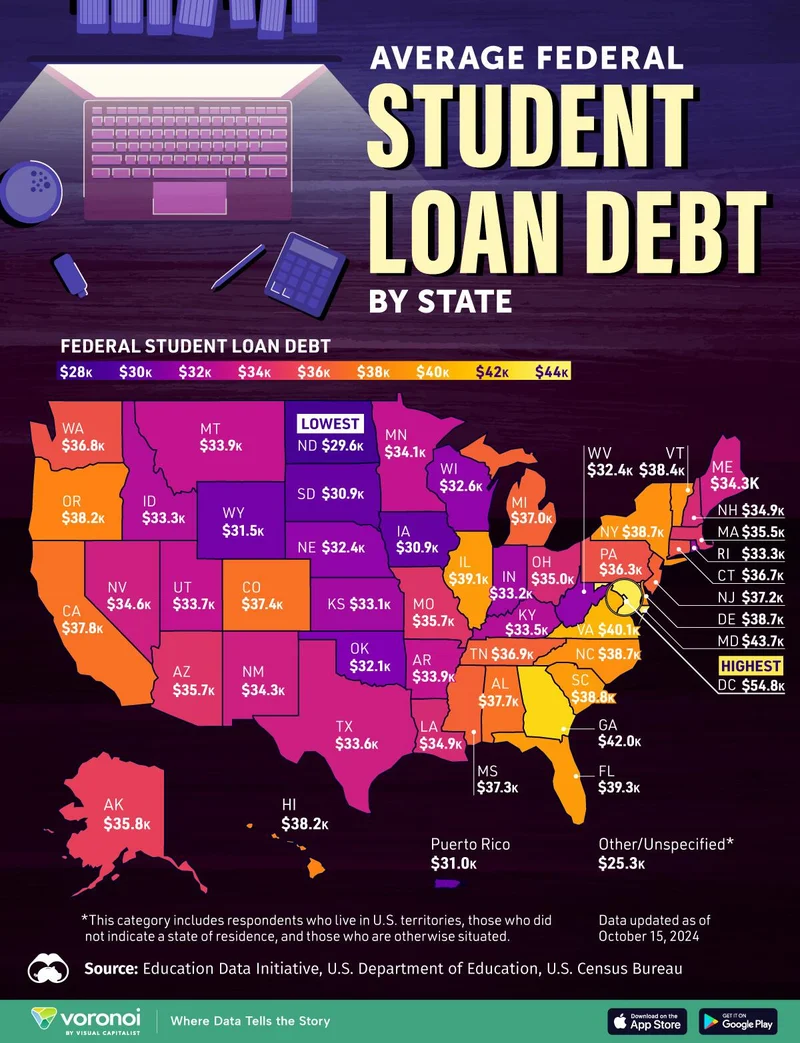

Let's stop pretending this is a serious fiscal policy discussion. It's not. This is a punitive, ideological move designed to handcuff future governments and punish a generation of educated voters. It’s about taking a public utility—and yes, federal student lending is a utility—and turning it over to privateers so they can charge a toll. The numbers don't add up, the logic is pretzel-shaped, and the only clear outcome is misery for millions. This isn't about the total federal student loan debt; it's about control. They're not just selling a loan portfolio. They're selling your future stability to the lowest bidder.