Article Directory

Alright, let's dive into this latest Fed move, folks. Another quarter-point cut—bringing us to a 3.75%-4% range. On the surface, it's pretty straightforward. The Fed's trying to goose the economy, keep things humming along, especially with those "downside risks to employment" they mentioned. They're nudging borrowing costs down, hoping we all go out and spend a little more, invest a little more. But is it just a simple tweak, or is there something deeper going on here? I think it's the latter.

Decoding the Signals

Think of the economy as a giant machine, right? The Fed's job is to keep it well-oiled, prevent it from overheating or grinding to a halt. And right now, there's a bit of sputtering. Inflation's cooled off from that crazy 9.1% peak in 2022—thank goodness—but it's still hovering above the Fed's 2% target. And with the government shutdown throwing a wrench into the data flow, it's like trying to fix that machine blindfolded.

The interesting thing is the division within the Fed itself. That's what caught my eye. Ten members voted for the cut, sure, but we had Governor Miran wanting a bigger cut (0.50%), and President Schmid wanting no change at all. That tells you there's no consensus about the best path forward. It's like a team of doctors arguing over the right diagnosis, and when doctors disagree... well, you know.

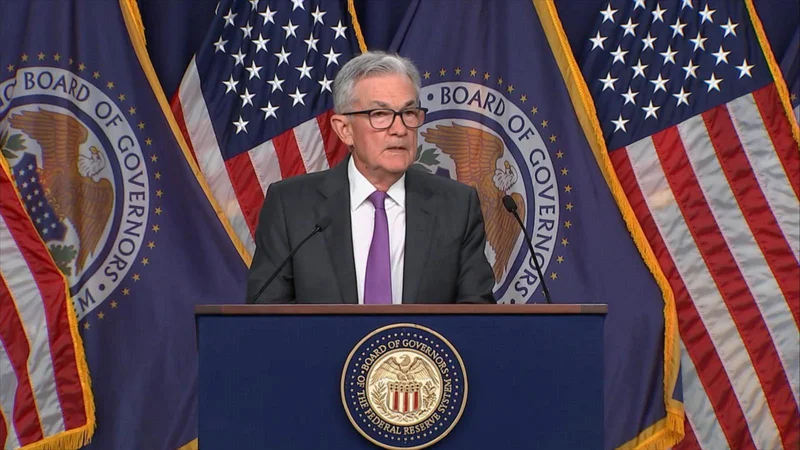

Powell's comments after the announcement didn't exactly calm the waters either. Saying another cut in December "isn't a foregone conclusion"? That sent a shiver through the markets. The S&P 500 and the Dow dipped because investors hate uncertainty more than anything. Chris Zaccarelli at Northlight Asset Management hit the nail on the head: the market was hoping for a clear signal of continued easing, and Powell basically said, "maybe, maybe not."

This is the kind of thing that reminds me why I got into this field in the first place: the puzzle of trying to understand the future.

Now, let's talk about that government shutdown. The Fed's making decisions based on incomplete information. The September jobs report is MIA, thanks to political gridlock. The ADP report showed a contraction in private-sector jobs, but how reliable is that? It's like navigating a ship through a fog, relying on a broken compass. It complicates everything. How do you steer the economy when you can't see where you're going?

We also need to consider the global context. The Trump-era tariffs are still hanging around, even though their impact has been "more muted" than expected. But muted doesn't mean nonexistent. They're still adding to the cost of goods, putting pressure on prices. And let's not forget the general slowdown in global growth, which is impacting everyone.

A Glimmer of Hope?

So, where does that leave us? Are we headed for a recession? I don't think so. But I do think we're in for a period of increased volatility and uncertainty. The Fed's trying to walk a tightrope, balancing the need to support growth with the need to keep inflation in check. And they're doing it with one hand tied behind their back, thanks to the data blackout.

But here's the thing: human ingenuity is incredible. We've faced economic challenges before, and we've always found a way to overcome them. We adapt, we innovate, we find new solutions. And I believe we'll do it again.

This rate cut is not just a band-aid, but a signal. It's a sign that the Fed is paying attention, that they're willing to act. And it's a reminder that we're all in this together. We all have a stake in the success of the economy.

What does that look like, though? What kind of new solutions are we talking about? How will businesses adapt to this new environment? These are the questions we need to be asking.

A Window of Opportunity

I believe this moment of uncertainty can be a catalyst for innovation. It can push us to find new ways to create jobs, to boost productivity, to build a more resilient economy. It's a chance to rethink our assumptions, to challenge the status quo, to create a better future for ourselves and for generations to come. When I think about the potential for human innovation, I honestly get chills.

So, let's not focus on the doom and gloom. Let's focus on the opportunities. Let's use this moment to build something better, something stronger, something more sustainable. Because that's what we do. That's what humans do.

A Dose of Reality

Of course, with every new technology, every new economic policy, there are potential risks. We need to be mindful of the ethical implications of our decisions. We need to ensure that the benefits of progress are shared by all, not just a select few. But I believe that with careful planning and responsible leadership, we can navigate these challenges and create a future that is both prosperous and just.

The Future is Being Written Now

The Fed's rate cut is more than just a monetary policy decision; it's a chapter in a much larger story. It's a story about our ability to adapt, to innovate, and to overcome challenges. And it's a story that we're all writing together, right now.