Article Directory

So, Meta had a "strong" quarter. You’ll have to forgive me if I don’t pop the champagne.

Wall Street gets sold a bill of goods every three months, and this time was a classic. The headline numbers looked shiny enough: $51.2 billion in revenue, up a cool 26%. Ad impressions are up, ad pricing is up. On paper, it’s the kind of report you print out and frame. But anyone who actually read past the first paragraph of the press release saw the flashing red lights and heard the sirens. The stock didn't tank 12% because of a "one-time tax charge." Give me a break.

The market isn't stupid. Well, it's frequently stupid, but not about this. It panicked because Meta’s C-suite basically stood on a table, lit a mountain of cash on fire, and promised to bring an even bigger mountain with a flamethrower in 2026.

The Good, The Bad, and The Utterly Insane

Let’s get this straight. Your revenue grows by 26%, but your expenses balloon by 32%. Your capital expenditures—the cash you’re dumping into servers, buildings, and God knows what else—more than doubled from last year to a staggering $19.4 billion. In a single quarter.

This isn’t a growth strategy. This is a Vegas gambler on a losing streak, doubling down on a terrible hand because he thinks his luck has to turn around eventually. The house always wins, pal. Meta just posted a "win" on the revenue slot machine, then immediately took all the winnings and shoved them into some back-alley, high-stakes poker game called "AI Supremacy," with no guarantee of a payout.

This is a bad plan. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of financial planning. It’s the kind of spending that makes the Metaverse fiasco look like a quaint, fiscally responsible little side project. At least with the Metaverse, we got some legless avatars to laugh at. What are we getting for this?

And what’s truly mind-boggling is the sheer audacity of it. They presented these numbers as if they were just the cost of doing business, the price of innovation. But what innovation, exactly? Are they building a sentient AI that will solve world hunger, or just one that can generate more creepily accurate ads for things you only thought about buying?

Welcome to the 2026 "Blank Check" Bonanza

If the Q3 spending was a red flag, the 2026 forecast was a nuclear air-raid siren. CFO Susan Li got on the earnings call and, in the calmest, most terrifying corporate-speak imaginable, told investors to brace for impact.

Her words were that 2026 expenses will grow at a "significantly faster" rate and capital spending growth will be "notably larger." Let me translate that for you: "We are taking the corporate credit card, removing the limit, and going on a multi-hundred-billion-dollar bender. We have no concrete budget. We have no clear ROI. Just trust us."

Trust them? After the Metaverse? After the endless privacy scandals? They expect us to just nod along while they shovel billions into a furnace, and for what, exactly...

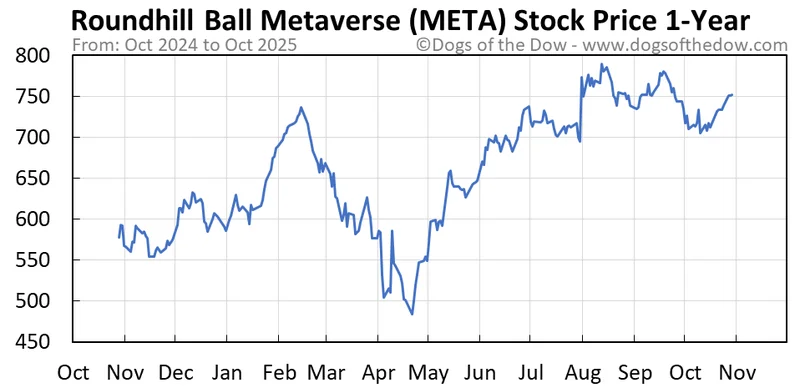

The whole thing reminds me of when my internet provider sends me that smarmy email about how they're "investing in the network," which is code for "your bill is going up 20% and your service will be exactly the same." It's a shakedown, wrapped in the flag of "progress." And offcourse, the market reacted accordingly. The `meta stock price today` reflects a sudden, violent dose of reality. Investors who were happy to ride the wave of the rising `meta share price` all year suddenly saw the iceberg. This reaction is Why Meta Stock Is Down Big Today.

Then again, maybe I'm the crazy one. Maybe this is what it takes to compete with the spending of `microsoft stock` and `google stock`. Maybe building a world-dominating AI really does cost more than the GDP of Portugal. But are we even sure that’s what they’re building? Or are they just desperately trying not to become the next MySpace in an AI-powered world?

So They're Just Printing Monopoly Money Now?

Here's the real story. Meta is acting like a company that's terrified of being left behind, and it's throwing infinite, imaginary money at the problem. They saw what happened with mobile, and they're damned if they'll miss the next great platform shift. The problem is, they're funding this panic-driven arms race with real investor cash, and the 12% haircut on the stock is the first sign that the people footing the bill are starting to ask for a receipt. This isn't a bold vision for the future; it's the most expensive mid-life crisis in corporate history.