Article Directory

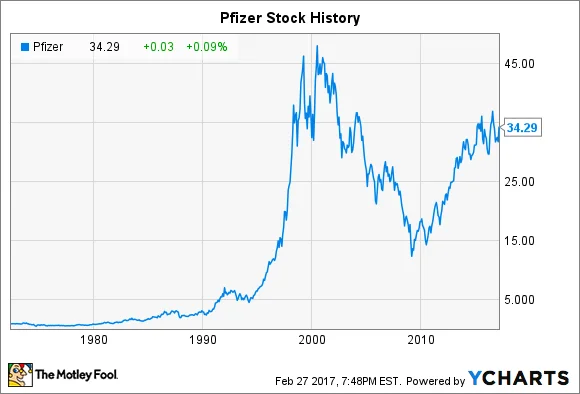

Let's be real for a second. The sudden burst of life in Pfizer's stock is the corporate equivalent of a defibrillator shock to a flatlining patient. For years, PFE has been the sad, forgotten giant of pharma, lumbering around while its peers were sprinting. Now, after a couple of splashy headlines in September, Wall Street is acting like they’ve discovered the fountain of youth in a dusty old lab.

The stock jumps 15% in a week. Analysts start using words like "turnaround" and "bargain." Give me a break.

We saw a classic two-pronged PR blitz: a big, showy deal with the Trump administration and a massive, eye-watering check written to buy into the one party Pfizer wasn't invited to—the obesity drug bonanza. And just like that, the narrative shifted, prompting questions like, Pfizer (PFE) Stock Rebounds on Trump Drug Deal & Obesity Gamble – Can the Rally Last? But has the company actually changed? Or did it just get a really expensive makeover to distract from the fact that the foundation is still cracking? I’m betting on the latter.

The White House Wink and a Nod

First, let's talk about this "landmark agreement" with Trump. Pfizer agrees to cut some Medicaid drug prices in exchange for avoiding crippling tariffs. The press calls it a "win-win." A win for who, exactly? Pfizer gets to dodge a massive financial bullet and earns a pat on the head from the White House, effectively buying political cover. The administration gets a talking point for their "TrumpRx" website that will probably be a bureaucratic mess.

But what about us? Does this mean our prescriptions are suddenly affordable? Offcourse not. This is a targeted discount for a specific government program, negotiated under duress. It’s a strategic sacrifice, a chess move to protect the king. Pfizer’s CEO stood there at the White House, talking about securing "certainty" on tariffs and drug pricing. My translation: "We threw them a bone so they'd leave our real profit centers alone."

This isn't a bold new direction in corporate responsibility. This is crisis management, plain and simple. It’s like a mob boss paying protection money to keep the peace on his block. It works for a while, but it doesn't solve the underlying problem. What happens when the political winds shift and the next administration wants its own pound of flesh? Are we just going to see another round of these backroom deals?

Buying Your Way to the Cool Kids' Table

The second act of this desperate play is the $7.3 billion acquisition of Metsera. This is a bad idea. No, "bad" doesn't cover it—this is a five-alarm panic buy. Pfizer tried and failed to develop its own blockbuster weight-loss drug. It had to scrap its own candidate, danuglipron, because of safety issues. Meanwhile, Novo Nordisk and Eli Lilly were printing money with Ozempic and Zepbound, becoming the darlings of the market.

So what does a company with more money than ideas do? It buys its way in.

This $7.3 billion bet is being hailed as a "budget entry-point" to the obesity market. A budget entry? It's a Hail Mary pass based on mid-stage trial data. We've all seen how that story can end. The data looks "promising"—showing weight loss on par with Lilly's drug—but we are years away from knowing if this thing will ever see the light of day. Promising drugs fail in Phase 3 trials all the time. It's the nature of the beast.

Pfizer is essentially paying a premium to get a lottery ticket. It’s like a washed-up 80s rock band, whose own creative well has run dry, paying a fortune to license a hit pop song hoping their old fans will think they’re still relevant. Maybe it works, but it feels hollow, doesn't it? They're not innovating here; they're acquiring. And they’re late to the party. By the time any Metsera drug hits the market in 2026 or 2027, will anyone even care, or will they be loyal to the brands that got there first?

Look, the oncology pipeline from the Seagen acquisition shows some real promise, with a bladder cancer combo cutting death risk by 50%. That's genuinely good news and a testament to actual science. But it gets buried under the noise of these two massive, narrative-driving gambles. The company is cutting $4 billion in costs to stay lean while simultaneously throwing over $7 billion at a maybe, and we're supposed to applaud the shrewd business acumen...

Then again, maybe I'm the crazy one here. Wall Street loves a good story, and Pfizer just wrote two new chapters. The actual fundementals—the looming patent cliff for Eliquis, the post-COVID sales hangover—are boring. A fight with the president and a multi-billion-dollar bet on the hottest drug market in a generation? That's a story you can sell.

So, Am I Buying? Give Me a Break.

Let's put the pieces together. You have a company whose stock has been garbage for five years. Its biggest cash cow, the COVID franchise, is drying up. It's facing a brutal patent cliff on one of its most important drugs. So, it makes a deal with a politician to avoid tariffs and throws a mountain of cash at a biotech startup to play catch-up in a market it completely missed.

This isn't a turnaround. It's a distraction.

That juicy 7% dividend everyone loves? That's the cheese in the mousetrap. It's there to keep you patient while management hopes one of these wild bets pays off. But hope is not a strategy. The core business is still facing the same headwinds it was three months ago. Nothing has fundamentally changed except the headlines. This is a classic value trap until they can prove—with actual, sustained earnings from new, approved products—that they've truly turned the ship around. Until then, I'm staying far away.