Article Directory

Let's be real for a second. The tech world loves a good rocket ship story. A plucky upstart, riding the wave of the next big thing, making Wall Street analysts look like geniuses and early investors feel like they’ve cracked the Da Vinci Code. Right now, that rocket ship has "Supermicro" painted on the side, and it's fueled by the highest-octane hype fuel known to man: AI.

The numbers are, on the surface, staggering. Fiscal 2025 revenue hit nearly $22 billion, almost triple what it was just a couple of years ago. CEO Charles Liang boasts about being the first to market with the latest and greatest NVIDIA and AMD chips, and he’s not wrong. They've become the go-to guys for companies desperate to build out their AI data centers yesterday. The stock chart, for most of the year, looked like an ECG of a person who just saw a ghost. Up, up, and away.

But I've been doing this long enough to know that when a rocket flies that high, that fast, you need to start looking for cracks in the fuselage. And with Supermicro (SMCI), the cracks are starting to look like canyons. They missed their Q4 sales estimates—by a hair, sure—but on Wall Street, a miss is a miss. The stock tanked 15% in response. Why such a brutal reaction? Because everyone knows this ride is built on momentum, and the second it slows, people start heading for the exits. It's a familiar story for a stock where headlines like 'Super Micro Computer (NASDAQ:SMCI) Stock Price Down 8.7% - Here's What Happened' are not uncommon.

The Margin is the Message

Here’s the part of the story the cheerleaders don’t want to talk about. It’s the dirty little secret hiding in the financial statements: Supermicro’s gross margins have slipped to a pathetic 9.5%.

Let me translate that for you. It's like building and selling a state-of-the-art Italian supercar, a masterpiece of engineering, and your total profit on the deal is what you'd make selling a used lawnmower. The company is doing massive volume, but they're barely making any money on each sale. This is a bad sign. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of a metric. It tells you everything you need to know about the pressure they're under.

Why are the margins so thin? Two words: the competition. For a while, Supermicro was the nimble speedboat, zipping around the lumbering aircraft carriers of the tech world. But now, those carriers—Dell and Hewlett Packard Enterprise—have turned their massive turrets in SMCI's direction.

Dell did $96 billion in revenue last year. Their server division alone is double the size of Supermicro's entire company. HPE is right there with them, bundling hardware with their GreenLake service platform. These giants have billion-dollar relationships with every Fortune 500 company on the planet. They can afford to lose money on a server deal to win a massive cloud contract. Can Supermicro? What happens when Dell walks into a meeting and says, "We'll match Supermicro's price, and we'll throw in enterprise support and financing"? The game changes, fast. These corporate buyers, they want one throat to choke when things go sideways, and honestly...

It reminds me of every time I've had to deal with corporate IT. They don't buy the best tech; they buy the safest vendor. They buy the company that won't get them fired. Right now, Supermicro is still the risky bet.

A Gambler's Stock, Not an Investor's

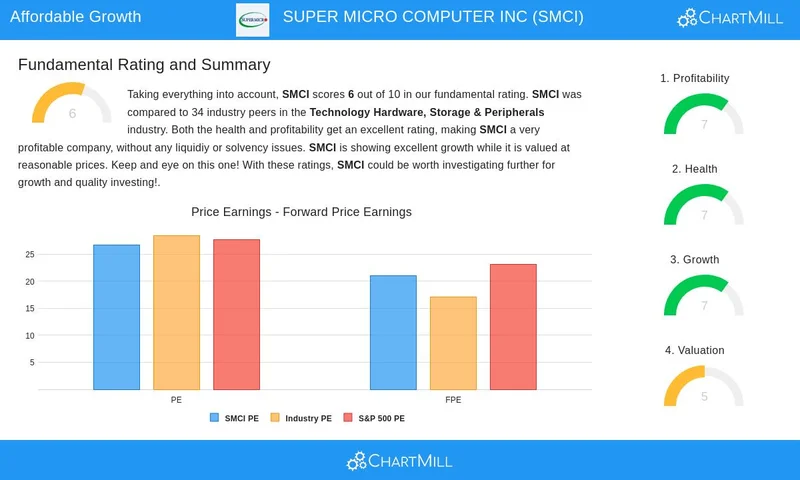

If you want to know how confused everyone is, just look at the Wall Street analyst targets. They're all over the map, constantly debating the question: Is SMCI Stock a Buy, Sell or Hold at a P/E Multiple of 23.39X? Needham is pounding the table with a $60 target, high on the AI fumes. Then you've got Goldman Sachs, which basically called the company worthless with a $27 target. When the "experts" have a price gap that wide, it means they're not analyzing—they're guessing. They're throwing darts at a board in the dark.

The whole thing feels less like an investment and more like a Vegas poker table. The recent pop in the stock came because AMD announced a deal with OpenAI. Supermicro is an AMD partner, so the stock jumped in sympathy. That’s not a business fundamental; that’s riding on someone else's coattails. It's a classic case of Wall Street wanting to have its cake and eat it to. Offcourse they're excited about AI, but they're terrified of the actual business model.

Then again, maybe I'm just the cynical old guy yelling at the clouds. Maybe the AI boom is so massive that there's enough room for everyone, and Supermicro's speed will keep it ahead of the big guys. Maybe their liquid-cooling tech is a genuine moat that Dell can't easily cross. But does that justify a stock that swings 15% on a whisper? I don't think so.

This is a Squeeze Play, Not a Victory Lap

Look, don't get hypnotized by the triple-digit growth and the AI buzzwords. Strip all that away and what are you left with? A company with shrinking profitability, facing down competitors with infinitely deeper pockets, in a market where one wrong step sends your stock off a cliff. Supermicro isn't the story of a plucky underdog winning the championship anymore. It's the story of an underdog that made it to the final round and now has to face a tag team of Andre the Giant and Hulk Hogan. This isn't a tech story; it's a survival story. And I wouldn't bet my own money on the ending.